Written by Thomas Willett, RPh MBA, Vice President of New Site Operations

It’s no secret that the cost of health care in the United States has risen dramatically over the last several decades. Part of that increase is the development of new classes of drugs meant to treat previously hard-to-treat conditions. These new drug classes are therapies targeted for specific conditions that generally have less side effects than older medications. However, these drugs are often complex in nature and usually very expensive. To control these costs, regulators have created pathways to make “copies” of these drugs to help promote competition between manufacturers. This article will explore this group of drugs, known collectively as biosimilars.

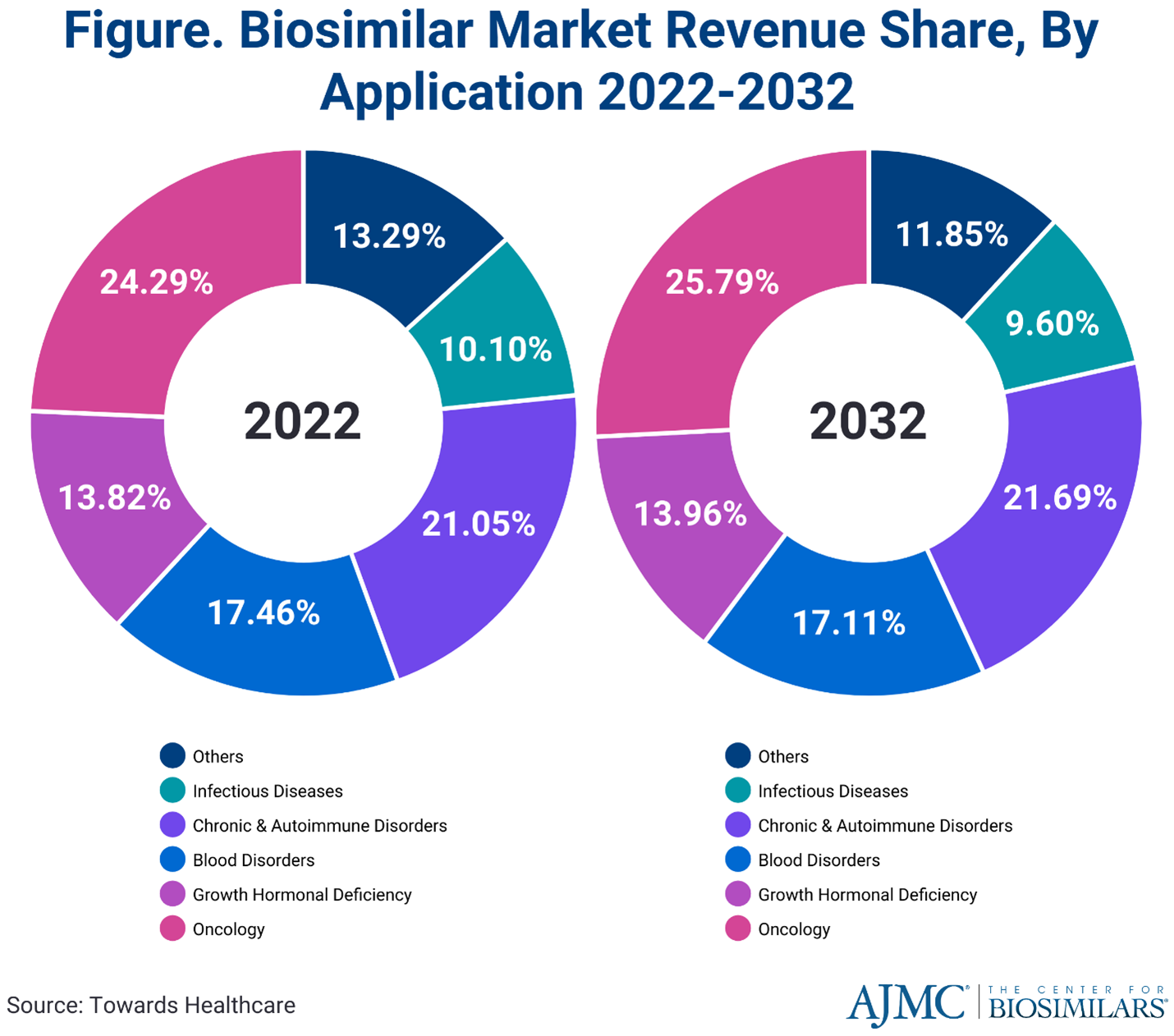

Newer therapies have led to more options for patients, but higher costs for the health care system. The introduction of biosimilars has helped to reduce the rate of cost increases caused by those therapies. They have proven to be safe and effective for patients while reducing out-of-pocket expenditures. Even so, the global biosimilar market is projected to surge from $25.1 billion in 2022 to approximately $1.3 trillion by 2032, with a compound annual growth rate of 17.6%. Infusion Associates will continue to keep patients and medical providers informed and educated about treatment options that have biosimilars to lower the costs of these newer therapies.

What is a biosimilar?

The FDA defines a biosimilar as a biological product that is highly similar to and has no clinically meaningful differences from an existing FDA-approved reference product (I.e. the “brand name drug”). Biological products are generally complex molecules derived from a biological source (bacteria, plant, etc.). If a molecule is “similar” enough, the effects on the body are indistinguishable from the originator reference product. That similarity is determined through testing and submission of those results for FDA approval.

Why can’t we call it a generic?

Generic drugs are simple molecules that are exact copies of innovator drugs that have lost patent protection. The process to approve generics through a simplified process has been around since the 1960s. This has resulted in competition within drug classes and helped drive down health care costs.

A pathway for approving biosimilar drugs in the U.S. was not in place until 2010 when the BPCIA (Biologics Price Competition and Innovation Act) was signed into law. This act allowed a similar mechanism to help develop and market copies of complex biological products. In Europe, biosimilars have been available since the early 2000s, so the U.S. had a good model for this process. To summarize, biological products are complex and are more difficult to obtain interchangeability status than simple generic products. You can read more on interchangeability status later in this article.

Biosimilars Reduce Costs and Improve Market Access

Drug manufacturers competing to develop new biosimilars help to drive down costs and improve market access for drugs. Biological drugs often target chronic conditions that are difficult to treat and have little or no alternative therapies. Research and development costs are high, and they require expensive, complicated manufacturing processes. To recover costs, drug manufacturers require high sales prices to recoup their investment and drive further innovation. With drug manufacturers competing to develop new biosimilars, there is incentive to lower prices as products mature in their life cycle.

The first biosimilar released in the us in 2015 was Filgrastim – sndz (Zarxio). It is a supportive care drug with multiple approved uses. Currently there are 57 approved biosimilars for the US market representing many indications and medical specialties.

Biosimilars are named with the non-branded drug name, followed by a 4-character manufacturer code designation. They are also given a unique manufacturer trade name as well. Cancer drugs were extensively targeted as initial biosimilar approvals due to the cost and utilization of these drugs. Other therapies now include infliximab (Remicade™) and adalimumab (Humira™) due to their high patient volume and chronic therapy designation.

Source: Drugs.com

Source: Drugs.com

Healthcare’s Push to Adopt Biosimilars

Specialty drugs account for 2% of drug market by volume, but 33-50%+ of drugs spending currently. The US government spends hundreds of billions of dollars on prescriptions drugs yearly via various publicly funded programs (Medicare, Medicaid, Tricare, Indian Health Services, others). Drug spend accounts for 9-13% of the total health care dollars spent.

Biologic products make up majority of that figure. With more specialty drugs on the horizon, this is expected to increase. Having more than one option for patient treatment helps to decrease costs through competition amongst manufacturers.

Another reason is that single source drugs (those that are only made by one company) are susceptible to supply chain issues such as raw material shortages, natural disasters, and economic constraints. Having multiple biosimilar options for a particular brand name drug helps to increase supply by expanding the pool of drugs available to treat patients.

Biosimilar Adoption: Slower Than Expected

There has been significant pushback from innovator companies. They have raised issues with the biosimilar approval process and concerns about safety and effectiveness of biosimilar products, none of which has been born out in the testing process. Furthermore, insurance companies utilize an incentive process for approving biosimilars on their approved drug lists (called a formulary) that doesn’t always align with the lower cost of a biosimilar.

It can be confusing for medical providers to navigate a patchwork of state laws regarding what is acceptable practice for substituting a biosimilar for a reference drug. Some patients and providers may feel uneasy changing a therapy that has worked for months or years without any changes.

How does Infusion Associates utilize biosimilars?

Our medical providers and educational staff review long-term studies that support the “interchangeability” of these drugs and the safety of these treatments for patients. We also support the utilization of approved biosimilar therapies to maintain access and reduce the cost burden for our patients. Insurance companies often mandate the use of a specific biosimilar product as the first required therapy for a patient’s treatment to be covered on their insurance plan. Our billing staff streamlines access to these treatments by getting drug selection approval prior to your treatment and ensuring the lowest out-of-pocket costs for our patients.

What Is Interchangeability?

We already know that biosimilars must have no clinically meaningful differences from the reference or brand name product. To help improve confidence around biosimilars amongst medical providers and patients, the FDA recognized a more stringent standard known as “interchangeability.”

FDA – An interchangeable biological product is a biosimilar that meets additional requirements and may be substituted for the reference product at the pharmacy, depending on state pharmacy laws.

An interchangeable biosimilar may be substituted at the pharmacy or administering provider for the reference product without additional approval of the prescribing health care provider. This process is similar to how a generic drug is substituted for a brand name drug, but with more requirements. Specific state rules vary as to what notification needs to be given to the prescribing provider when a pharmacy or infusion center selects a biosimilar instead of the reference product.

Interchangeability studies are more rigorous and include a back-and-forth switch between originator and biosimilar drugs that demonstrate no meaningful differences between the activity of the 2 agents.

Why isn’t the interchangeability status required?

There is an additional cost and time needed to run the studies, which can increase the cost of the drug and delay its release to the market. The rush to get a product on the market often means getting approval by the shortest method possible. However, having interchangeability status can help improve the odds of getting insurance coverage and increases medical provider and patient confidence in the biosimilar.

Future Trends In The Biosimilar Landscape:

With the success of biosimilars in the market today, expect to see:

- More drugs electing to gain interchangeability as patent protection expires, both for the drug and the manufacturing processes.

- Further insurance pressures to switch from reference drug to biosimilars for cost savings

- More drug classes with biosimilar availability

- Creative contracts evolving with value-based care models (contracts that are based on the outcomes of treatment with the drug)

- Greater formulary committee involvement in biosimilar selection by medical staff providers

- More in-depth post marketing studies to support clinical equivalence and interchangeability

- Streamlining of regulatory pathways to make adoptability more efficient

Last Words

Thank you for reading this article to learn more about biosimilars and their predicted future usage in healthcare settings. Our team at Infusion Associates is committed to keeping patients and medical providers informed and educated about treatment options that have biosimilars to lower the costs of these newer therapies. With questions about this article or biosimilars that Infusion Associates administers, please email info@infusionassociates.com.